How Learnership Programmes for Employees Can Benefit Organizations?

A survey conducted by the concerned South African authorities revealed that during the initial quarter of 2021, the official unemployment rate stood at about 32.6%. Approximately 46.3% of the youth population suffers from unemployment. A severe epidemic combined with a lack of education as well as relevant job skills is what the country has been experiencing. It will be useful for organizations to introduce different skills training programs.

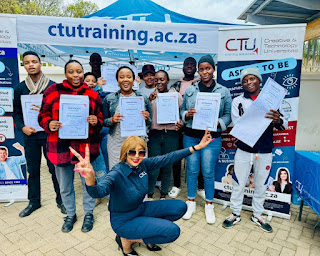

Leadership Programs

There are developed numerous Learnership Programmes for Employees. Successful completion can help derive nationally qualified qualifications. At the same time, easy access should be provided to on-the-job training. It can help boost economic growth and their bottom line. Adopting leadership can uplift essential skills in the country while enhancing access to proper employment. Organizations implementing such learning programs are likely to avail the opportunities and also benefit their BBBEE scorecard.

Discretionary, Mandatory Grants

Organizations claiming to have payrolls of over R500,000 annually should contribute one percent as SDL (skills development levy) of its leviable payroll. From this 1%, about 80% is to be allocated towards Setas and the rest 20% towards NSF (National Skills Fund). Timely payment of SDLS along with WSP (workplace skills plan) and ATR (annual training report) submission should be done by 30th April every year. Doing so entitles them to make applications for mandatory and discretionary grants from Seta.

About Mandatory and Discretionary Grants

In the case of mandatory grants, employers having good Seta standing and submitted successfully their annual ATRs and WSPs can derive mandatory grants. They also can claim about 20 percent of the total amount paid for SDL for the year. When a discretionary grant is concerned, employers may apply for the same. Payment is to be made at Seta’s sole discretion which will be based on proposed training plans that are included within the organization’s WSP.

Other Aspects Concerning Discretionary Grants

About 80% of such grants get allocated toward pivotal programs. It includes bursaries, learnerships, internships, skills programmes, work-integrated learning, etc. The rest 20 percent is generally allocated toward non-pivotal programs. These are rather non-credit programs or those that do not result in a full qualification. Such grants are offered from SDL’s remaining 80 percent. It will be essential to know them in detail to benefit from the same.

Tax Incentives

Businesses using learnerships can benefit from tax-related rebates. Concerning the IT (Income Tax) Act of S21H, employers having registered learnership agreements may seek tax deductions. Besides this organizations can use learnership to derive annual tax rebate benefits of R80,000 per able-bodied learner while for every disabled learner it is R120,000. Sponsor or employer hiring costs can be reduced considerably with ETI (employee tax incentive). It is achieved through a cost-sharing mechanism that is adopted by the government.

PAYE Reduction

The above helps reduce PAYE (pay as you earn) amount while employee received wage remains unaffected. ETI value that the employer is eligible to claim is likely to be unaffected. Moreover, the ETI value that the employer might claim is based on the monthly remuneration value that the qualifying employee receives. As per ETI, employing anyone between 15-29 years and earning a monthly amount less than R6,000, a PAYE amount reduction can be applied for the amount to be paid for that employee.

Comments

Post a Comment